Contents

Individual investors also get involved in the marketplace with currency speculation to improve their own financial situation. An online forex broker acts as an intermediary, enabling retail traders to access online trading platforms to speculate on currencies and their price movements. Forex is traded on the forex market, which is open to buy and sell currencies 24 hours a day, five days a week and is used by banks, businesses, investment firms, hedge funds and retail traders.

All of them have a lot to teach you on how to profit and make money with Forex. Reading the stories of profitable Forex traders’ road to success can also give you ideas on what to do, as well as which mistakes to avoid, without sacrificing any of your trading capital. We’ve all heard of stories of Forex tradersthat made millions in the markets in the short term.

Treat Trading as a Business

Let’s say your trading strategy has a positive expectancy and generates a return of 20R per year. The frequency of your trades is important but it’s not enough to determine how much money you can make in forex trading. You’ve heard of traders making millions in the financial markets. Mitigate against forex trading risk with our range of stop and limit orders, and keep an eye on forex prices with customisable alerts. While that does magnify your profits, it also brings the risk of amplified losses – including losses that can exceed your margin . Leveraged trading therefore makes it extremely important to learn how to manage your risk.

There is no centralized exchange that dominates currency trade operations, and the potential for manipulation—through insider information about a company or stock—is lower. Automation of forex markets lends itself well to rapid execution of trading strategies. Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. If the investor had shorted the AUD and went long on the USD, then they would have profited from the change in value.

Forex trading

This is what causes the zig-zag pattern generally observable in most forex charts. When you go on holiday to a foreign country, generally you would need to convert your local currency into the currency corresponding to the country you are visiting. In short, you are making a trade and ‘exchanging’ currencies. The aim of technical analysis is to interpret patterns seen in charts that will help you find the right time and price level to both enter and exit the market.

How do I transfer money from forex to bank?

- Send your proof of identity and your passport and bank account number.

- If a Forex card is leftover, you will transfer the balance of your forex card to your bank account.

- Transfer funds via NEFT by submitting and cancelling a check.

For example, GBP/USD is a currency pair that involves buying the Great British pound and selling the US dollar. Let’s imagine it rose from 1.25 to 1.35 – it is Mill Trade Review a profitable situation for you, so you can close the trade at this point. Now, you can exchange your 80 euros back to 108 dollars, and get your profit of $8.

There is also no convincing evidence that they actually make a profit from trading. The forward and futures markets are primarily used by forex traders who want to speculate or hedge against future price changes in a currency. The exchange rates in these markets are based on what’s happening in the spot market, which is the largest forex volatility calculator of the forex markets and is where a majority of forex trades are executed. The US dollar is considered the most popular currency in the world, and constitutes around 60% of all central bank foreign exchange reserves. So it’s no surprise the US dollar is evident in many of the ‘majors’ , which make up 75% of all forex market trades.

It sums up what forex trading is at its core; traders wait for prices to dip and for the currency to be undervalued, then they would buy. To excel in a forex trading career, you will need to be comfortable in a high-stakes environment and prepared to handle appropriate levels of risk in your trading. With large amounts of capital and assets on the line, having a calm and steady demeanor in the face of ebbs and flows in currency markets can be helpful.

Exotic currency pairs

Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital. With careful risk management, an experienced and successful forex trader with a 55% win rate could make returns above 20% per month. The reason they are quoted in pairs is that, in every foreign exchange transaction, you are simultaneously buying one currency and selling another. While stan weinsteins secrets traders should have plans to limit losses, it is equally essential to protect profits. Nearly all trading platforms come with a practice account, sometimes called a simulated account or demo account, which allow traders to place hypothetical trades without a funded account. Perhaps the most important benefit of a practice account is that it allows a trader to become adept at order-entry techniques.

Is forex tax free in USA?

Forex futures and options are 1256 contracts and will be taxed according to the 60/40 rule. 60% of gains or losses will be treated as long-term capital gains and the remaining 40% as short-term. Spot forex traders are considered 988 traders and can deduct their losses.

Just like scalp trades, day trades rely on incremental gains throughout the day for trading. To accomplish this, a trader can buy or sell currencies in the forwardor swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in Europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Due to the complexity of regulations in different international jurisdictions, as FX trading does not have a single center, a deficit occurs for money laundering in this sector. Moreover, many people use multiple currencies through multiple companies in forex trading. Therefore, FX trading involves risks due to several difficulties tracking money.

I just want to point out that, if set the size of the bet as a percentage of your account ( let say 2%) instead of fixed bet size, the result would be very much different. Again Rayner i thanks you for you give me your exprence and trading formula even i will update you as my promise when the 180 day trade experment proformance after i finsh them. If you risk $5000, then you can make an average of $100,000 per year. If you risk $3000, then you can make an average of $60,000 per year. If you risk $1000, then you can make an average of $20,000 per year.

The currency forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets to hedge against future exchange rate fluctuations, but speculators take part in these markets as well. Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher interest rate. A large difference in rates can be highly profitable for the trader, especially if high leverage is used. However, with all levered investments this is a double edged sword, and large exchange rate price fluctuations can suddenly swing trades into huge losses.

Improve your trading potential

Assuming a net profit of $1,650, the return on the account for the month is 33% ($1,650 divided by $5,000). Forex trading can be extremely volatile, and an inexperienced trader can lose substantial sums. If you want to buy , you want the base currency to rise in value and then you would sell it back at a higher price. You would sell the pair if you think the base currency will depreciate relative to the quote currency. If you buy EUR/USD this simply means that you are buying the base currency and simultaneously selling the quote currency. The second listed currency on the right is called the counter or quote currency (in this example, the U.S. dollar).

Between 1954 and 1959, Japanese law was changed to allow foreign exchange dealings in many more Western currencies. Whatever your level of trading experience, it’s crucial to have access to your open positions. As per your strategy, place your forex trade with defined entry and exit points. Don’t forget to use risk management conditions, such as a take-profit or stop-loss order. If you can become an expert at netball betting, you may stand a better chance of finding the better odds. The same is true when you compare major currency pairs and exotics.

It is therefore possible to make money even during times of economic downturn, which is very fitting for the current state of the world. This is a factor that can be seen as both an advantage and a disadvantage to new traders. Leverage, however, is a very important factor nonetheless and must be made known to new traders. Buying and selling took time, as for every buyer there needs to be a seller and vice versa.

STICPAY is used in over 190 countries with 29 national currencies and three cryptocurrencies – Bitcoin , Ethereum , Litecoin – offered. Users can deposit and withdraw funds from their STICPAY accounts using Visa, Mastercard, UnionPay China, local and international bank wire, and cryptocurrency. The best online trading strategy is one that suits your preferences and financial circumstances. Find options that appeal to your interests and that you understand. The minimum deposit at online trading sites will vary, as will the size of the trades you can make.

The broad time horizon and coverage offer traders several opportunities to make profits or cover losses. The major forex market centers are Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich. Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire.

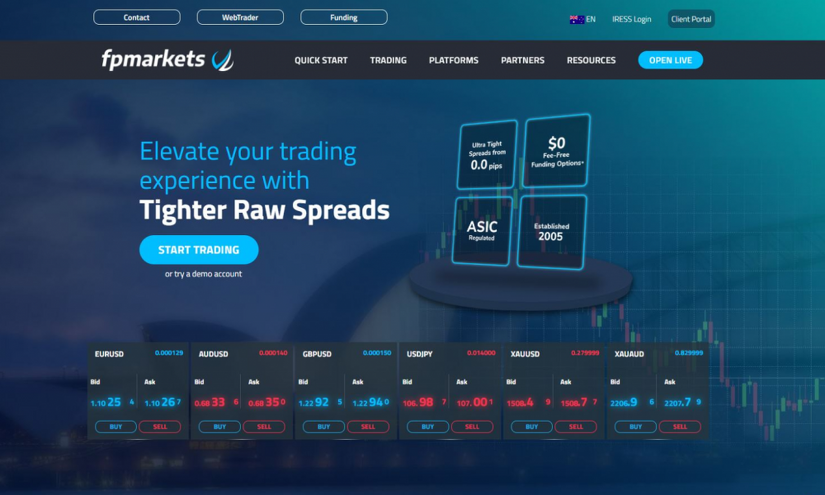

Live prices on our most popular markets

If traders believe that a currency is headed in a certain direction, they will trade accordingly and may convince others to follow suit, increasing or decreasing demand. Supply is controlled by central banks, who can announce measures that will have a significant effect on their currency’s price. Quantitative easing, for instance, involves injecting more money into an economy, and can cause its currency’s price to drop. I accept FBS Agreement conditions and Privacy policy and accept all risks inherent with trading operations on the world financial markets. Currency rate depends on its supply and demand, which may change depending on the economic situation of the country (GDP, inflation, the labor market situation, etc.).

Once the money is in your wallet you have instant access to it, either to keep and use in the wallet itself or transfer it back to a bank account or card connected with the account. If there’s even a small delay between you initiating a trade and it being completed, the prices could change and that can affect your potential profit. When you trade shares or commodities, the leverage is lower. However, the way in which any downswings are magnified will be less if the leverage is lower. Higher leverage can mean bigger losses when things go wrong. Traders with better credit and a better relationship with their brokers can get lower margins.

FXTM firmly believes that developing a sound understanding of the markets is your best chance at success as a forex trader. That’s why we offer a vast range of industry-leading educational resources in a variety of languages which are tailored to the needs of both new and more experienced traders. Once you’re ready to move on to live trading, we’ve also got a great range of trading accounts and online trading platforms to suit you. In order to make a profit in foreign exchange trading, you’ll want the market price to rise above the bid price if you are long, or fall below the ask price if you are short. Traded multiple currencies for experience and by Oct 19 i had lost around 120K. Changed my method and concentrated on yen/US from Nov onwards with an additional top up of 150K capital and recovered 120K by Dec 19 and today i am at 415K.

An opportunity exists to profit from changes that may increase or reduce one currency’s value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs. In addition to forwards and futures, options contracts are also traded on certain currency pairs. Forex options give holders the right, but not the obligation, to enter into a forex trade at a future date and for a pre-set exchange rate, before the option expires.

Just because forex is easy to get into doesn’t mean due diligence should be avoided. Line charts are used to identify big-picture trends for a currency. They are the most basic and common type of chart used by forex traders.

The reality of it, as emphasized in this article, is that trading is not an easy skill to learn. If you believe that traders are all trading against each other, this isn’t quite the case. Due to this factor, there hasn’t been a better time to enter the markets than now because finding a buyer or seller is easier than it’s ever been.

Also, events in one country in a region may spur positive/negative interest in a neighboring country and, in the process, affect its currency. The mere expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency. However, aggressive intervention might be used several times each year in countries with a dirty float currency regime. The combined resources of the market can easily overwhelm any central bank. Several scenarios of this nature were seen in the 1992–93 European Exchange Rate Mechanism collapse, and in more recent times in Asia. At the end of 1913, nearly half of the world’s foreign exchange was conducted using the pound sterling.

Don’t worry, creating a trading routine is easy – you just need to remain motivated and committed over time. The most important thing is to develop your own trading routine, one which fits your trading style and daily life. Then there are regional pairs, which are named for different geographic regions, for example Australasia or Scandinavia. People in fact tend to work together and collaborate trading ideas within communities, the most popular being Forex Factory.

Leverage may increase both profit and losses, and impulse trading should be kept in check. Therefore, always have a pre-set amount that you are ready to speculate. Never speculate with amounts that you cannot afford to lose.